Business Jet Value Development Through 2015

Daniel Hall, senior analyst at Ascend Flightglobal Consultancy, looks at how business jet value assumptions need to change.

The business jet community has been asking for three or four years now if the industry is finally in recovery, but each new year seems to bring a false dawn. So will 2015 finally be the year with a sustained recovery from the post-2008 downturn? Looking at the metric of new deliveries, we are certainly off to a good start. The total deliveries of 716 aircraft in 2014 represent a 7% increase on the 2013 total, and mark a reversal of five consecutive year-on-year declines.

We also see slow but steady improvements in inventory levels (which are moving downwards), and the continued strength of the US market, but there are concerns over utilisation, lack of secondary sales activity, and the global macroeconomic picture – particularly in Europe and parts of Asia. Order backlogs as well as asking prices remain weak. The lower oil prices of recent months may also impact demand from oil companies for new business jets.

One of the biggest drivers (and indicators) of a recovery is aircraft Market Values. Since 2008 there has been greater focus on the value of the asset, particularly residual values. As noted during our Q1 2015 edition of Inside Track on Business Jet Values, we are beginning to see better Market Value performance and stability among business jet types, with year-on-year declines of an average of 9.6% from Q1 2014 to Q1 2015, compared with 18% in the previous 12-month period.

As expected, in-production types fared better, showing an average 8% year-on-year decline in Market Values, while out-of-production models fell by an average of 11%. There remains a weak outlook for these types. Encouragingly, many types are now increasingly showing value stability. However, a lot has happened to Market Value performance over the recent years.

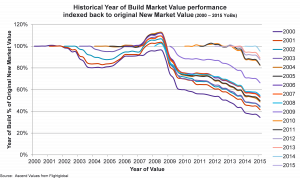

Many market participants once claimed that business jets showed excellent value retention – this was indeed true to a high degree. An index of original new Market Values for each vintage shows how in many cases, values would climb over time. However, most recently in the past six years, we have seen consistent depreciation. Business jets now need to be looked at as depreciating assets.

Values have evolved differently across the business jet size segments. If we index historical market value performance back to Q1 2007, we can see impressive value retention of bizliners (owing to their supply and demand, escalation, and interior completion components to value). There has been little difference between light cabin and midsize bizjets, but we can see better value retention with large cabin / long range aircraft, which is one of the reasons why financiers tend to favour these models.

Yet, this gap has been closing. When we plot the same index back to Q1 2012, all size segments fall together, indicating that the large cabin/long range segment has lost its distinctive Market Value performance advantage.

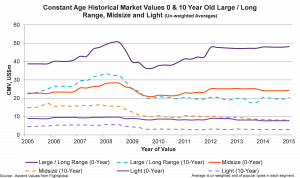

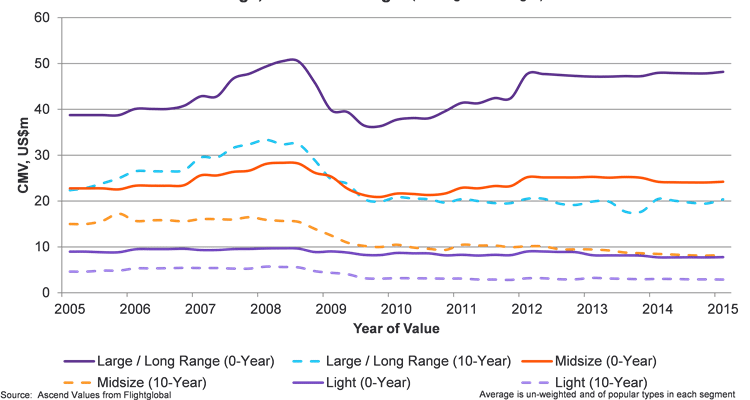

Looking at Values on a Constant Age basis allows us to compare the movement of values equally over time. Given the competitive nature of the business jet market, with some 100 variants competing with each other, we have averaged constant age values for the most popular types in each size segment.

Large cabin/long range and midsize business jets at new, 0-years of age have shown some improvements in value for most models; they have not quite peaked at the 2008 level, but we have seen new aircraft launches such as the Cessna Citation X+, Gulfstream G280 and Bombardier Challenger 350 improve new values.

Values for 10-year-old large cabin aircraft have not recovered, but on the plus side, they have not declined further either. The outlook is not particularly good as the segment will get far more competitive with many new models coming to the market in future years. Once large cabin business jets go out of production, we notably see their values weaken, particularly in times of downturn.

We have not seen any better with Midsize aircraft at this age; in fact, Challenger 604, Falcon 50EX and Falcon 2000 all have 10-year constant age values more than 50% lower than the mid-2008 peak, owing to them being older technology and replaced types. Ascend sees no recovery in sight for 10-year midsize bizjets as most are in steady decline, values-wise.

The Global Express classic is an interesting example as values have notably weakened over the past 24 months as the type seeks to balance supply and demand and find its position in the secondary market as a 10-year-old+ aircraft. It is also a true test of the secondary market for this size segment, given that this model was one of the first of this size and range to be available, at this age. Ascend has watched this closely, as this secondary value performance will be indicative in forming part of our opinion of Future Residual Values of large cabin / long range models as a whole.

The light jet segment is hugely competitive, and interestingly, their new values never peaked in 2007/2008 like other segments. Overall, the competing OEMs in this space (Cessna and Bombardier Learjet) have not really realised improved pricing on new models. At the 10-year age, we do see a fall down from the 2007/2008 peak, but again these have been hit hard by competition and a sustained weak market; most aircraft are at 33% of their new value, at age 10. Overall, there are some improvements in 0-year-old bizjets, but no business jet at 10 years of age has recovered to pre-2008 days.

New Base Values

The above analysis is part of a whole host of research which recently led Ascend to make major changes to Current Base Values and Future Value forecasts. These are detailed fully in an April 2015 edition of Inside Track on Business Jet Values.

Since the recession began in September 2008, Ascend has made just under 14,000 changes to Current Market Values across the 100+ business jet types and variants that we track and offer in our live appraisal service, the online Ascend Values from Flightglobal (formerly “V1”).

This provides us with substantial historical Market Value performance which crucially informs our Base and Future Value forecasts. Ascend is unique in the market in that it collates comprehensive historical Market Value performance to enable us to derive accurate and relied-upon Future Value curves.

Market Value performance of business jet types clearly shows us that the methods of depreciation pre-2008 categorically do not work in the same manner as in a post-2008 environment. Simply put, the old methods of depreciation at low percentages (typically 3-4%) do not correctly reflect future value performance, and financiers and owners have been, and will continue to be, caught out. Today this risk is likely to be even higher, particularly when considering aircraft production cycles from the manufacturers. Our Future Value depreciation curves have been steepened.

In addition, we have also clearly distinguished the performance of large cabin business jet models once they move out of production, a status which was not distinguishable pre-2008.

Daniel Hall

Senior Analyst, Ascend Flightglobal Consultancy

Tel: +1 646 746 6840