June 2017 Data Dashboard

Welcome to the Data Dashboard for June 2017. The Dashboard provides a quick summary of the business aviation industry each month, tracking trends and highlighting key points.

Aircraft Utilisation in Europe:

June marked the eighth consecutive month of continuous traffic growth in Europe, which has not been seen since 2010.

Utilisation in Europe was up 2.7% Year-on-Year (YoY) in June, with a total of 84,000 departures – making it the busiest month in 2017 so far.

Germany, Switzerland and the UK saw modest growth, however flights in Southern Europe were up 12% YoY, with flights in Spain and Italy enjoying 10% growth from last June.

Eastern Europe also saw year-on-year growth, with an 8% increase in departures.

Aircraft Utilisation in the United States:

Month to month, utilisation in the United States was down 0.3% overall. The turboprop market showed signs of growth, with utilisation up 2.9% in total. Part 91 operations increased by 0.5%. Large jet utilisation had the worst month to month statistics, with a sharp drop in fractional operations (-9.5%), and a decrease of -3/7% across all types of operations.

Credit: Argus

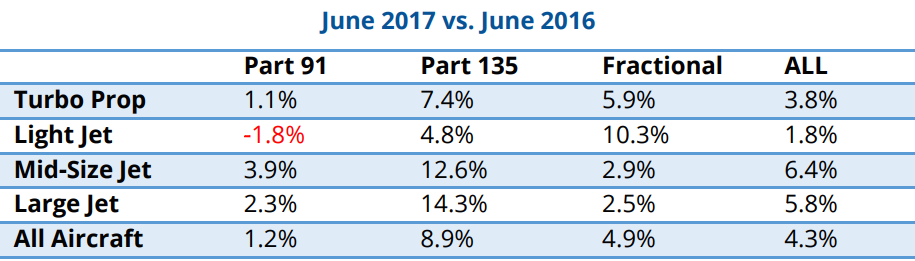

Year-on-year figures show a much brighter picture, with all aircraft categories averaging an increase in utilisation of 4.3%. Part 135 operations saw the largest increase in activity across all aircraft sizes, but the biggest surprise was the 10.3% YoY growth that the fractional market for light jets saw.

Credit: Argus

Pre-owned aircraft market:

Demand for pre-owned aircraft remained unchanged, with turboprop and light jets still showing the highest demand.

A smaller pricing decline, and a size of available aircraft are underlying signs that prices are beginning to stabilise.

The average asking price for large jets is at a record low, at just $12.1 million. G450s are moving noticeably quickly, with an average time on market of just 95 days.

Medium sized aircraft are slowly increasing in value, with the monthly average asking price of $3.09 million – up from the 12 month low of $3 million in February.

Asking prices for light jets continue to fall, with June recording an average asking price of $1.93 million – the lowest value in the last year.

Turboprops have had the best value retention, with an average asking price of $1.56 million – slightly lower than the 12 month average of $1.57 million. The PC-12 is spending the least amount of time on the market (101), with King Air C90s spending the most – averaging 646 days.

Asking price versus the final transaction price improved, most notably for light jets with a differential of 8.0%. Mid-sized aircraft had the biggest difference, increasing to 14.7%.

Source: Asset Insight

The maintenance exposure to ask price ratio did not improve during Q2, increasing the predicted marketing time for aircraft.

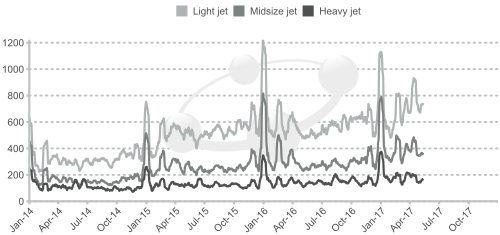

Charter activity US:

Credit: Avinode

June saw an increase in charter activity, with rises across all aircraft sectors from July 2017. Light jets posted the most growth, as well as the highest activity.

Charter activity EU:

Credit: Avinode

Charter activity in Europe had mixed results, with light and medium jets seeing a slight increase from May. Demand for large aircraft saw a slight decline, with the sector looking fairly stagnant in the long term.